A home equity loan, also known as a second mortgage, is a powerful financial tool that allows homeowners to tap into the equity they have built up in their property. This type of loan provides borrowers with access to a lump sum of money, which can be used for various purposes, such as home improvements, debt consolidation, education expenses, or other major expenses. In this article, we will explore the ins and outs of home equity loans, their benefits, considerations, and the responsible use of this valuable borrowing option.

Table of Contents

- Understanding Home Equity Loans

- What is Home Equity?

- How Home Equity Loans Work

- The Benefits of Home Equity Loans

- Lower Interest Rates

- Fixed Loan Amount

- Potential Tax Deductibility

- Considerations Before Taking a Home Equity Loan

- Assessing Your Financial Situation

- Understanding Loan Terms and Costs

- Home Equity Loan vs. Home Equity Line of Credit (HELOC)

- Key Differences

- Choosing the Right Option for You

- Using Home Equity Wisely

- Home Improvements

- Consolidating Debts

- Education Expenses

- Emergency Funds

- Responsible Borrowing Practices

- Borrow Only What You Need

- Budgeting for Repayments

- Avoiding Overleveraging

- Applying for a Home Equity Loan

- Gather Necessary Documentation

- Comparing Lenders

- Home Appraisal and Loan Approval

- Property Valuation

- Loan Approval Process

- Loan Repayment and Consequences of Default

- Monthly Payments

- Risks of Defaulting on Home Equity Loans

- Conclusion

- Leveraging Your Home Equity Wisely

Understanding Home Equity Loans

What is Home Equity?

Home equity represents the difference between the market value of your property and the outstanding mortgage balance. As homeowners make mortgage payments and the property’s value appreciates, their equity in the home grows.

How Home Equity Loans Work

Home equity loans allow homeowners to borrow against the equity they have accumulated in their property. The loan is typically provided as a lump sum, and borrowers repay it over a fixed term, similar to a traditional mortgage.

The Benefits of Home Equity Loans

Lower Interest Rates

Home equity loans often come with lower interest rates compared to other types of loans, making them an attractive borrowing option.

Fixed Loan Amount

With a home equity loan, borrowers receive a fixed loan amount, providing certainty and predictability in their borrowing.

Potential Tax Deductibility

In some cases, the interest paid on home equity loans may be tax-deductible, depending on the purpose of the loan and applicable tax laws.

Considerations Before Taking a Home Equity Loan

Assessing Your Financial Situation

Before applying for a home equity loan, consider your current financial situation, long-term goals, and ability to make loan repayments.

Understanding Loan Terms and Costs

Thoroughly review the loan terms, including interest rates, repayment period, and any associated fees, to ensure they align with your financial needs.

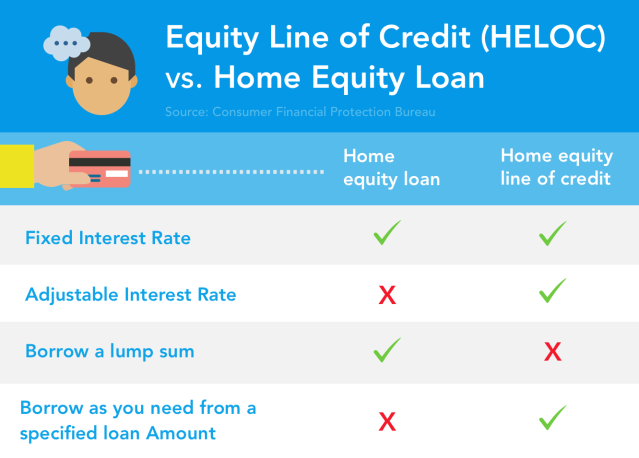

Home Equity Loan vs. Home Equity Line of Credit (HELOC)

Key Differences

While both options allow borrowers to access home equity, a home equity loan provides a lump sum, whereas a HELOC offers a revolving line of credit similar to a credit card.

Choosing the Right Option for You

Decide whether you need a lump sum for a specific expense (home equity loan) or prefer the flexibility of accessing funds as needed (HELOC).

Using Home Equity Wisely

Home Improvements

Investing in home improvements can increase the value of your property and enhance your living experience.

Consolidating Debts

Using a home equity loan to consolidate high-interest debts can help reduce overall interest payments and simplify finances.

Recommended:

- Student Loans: Understanding the Financial Lifeline for Higher Education

- FHA Loan: Understanding the Benefits and Requirements

- PennyMac: A Comprehensive Overview of a Leading Mortgage Lender

Education Expenses

Funding education expenses, such as college tuition, can be a wise use of home equity for long-term benefits.

Emergency Funds

Home equity loans can serve as a financial safety net for unexpected emergencies, providing peace of mind.

Responsible Borrowing Practices

Borrow Only What You Need

Avoid borrowing more than necessary to prevent overextending your finances.

Budgeting for Repayments

Create a budget to ensure you can comfortably make loan repayments without straining your finances.

Avoiding Overleveraging

Resist the temptation to use home equity for non-essential or risky investments that may lead to financial instability.

Applying for a Home Equity Loan

Gather Necessary Documentation

Prepare documents such as proof of income, property information, and credit history to streamline the application process.

Comparing Lenders

Obtain quotes and terms from different lenders to find the best home equity loan option for your needs.

Home Appraisal and Loan Approval

Property Valuation

The lender will conduct a home appraisal to determine the property’s current market value and assess the amount of equity available for borrowing.

Loan Approval Process

Upon approval, review the loan offer carefully, ensuring it aligns with the terms discussed during the application process.

Loan Repayment and Consequences of Default

Monthly Payments

Make timely monthly payments to avoid defaulting on the loan and potential foreclosure.

Risks of Defaulting on Home Equity Loans

Defaulting on a home equity loan can lead to the loss of your home, as the property serves as collateral for the loan.

Conclusion

Home equity loans offer homeowners a valuable opportunity to access the equity they have built in their property to meet various financial needs. By understanding the benefits, considerations, and responsible borrowing practices associated with home equity loans, borrowers can make informed decisions and leverage this financial tool wisely. Careful planning, budgeting, and using the funds for valuable purposes can help homeowners maximize the benefits of their home equity while maintaining financial stability and security.